Table of Contents

- How US Tariffs Challenge China - The New York Times

- China tariffs: good news and bad news

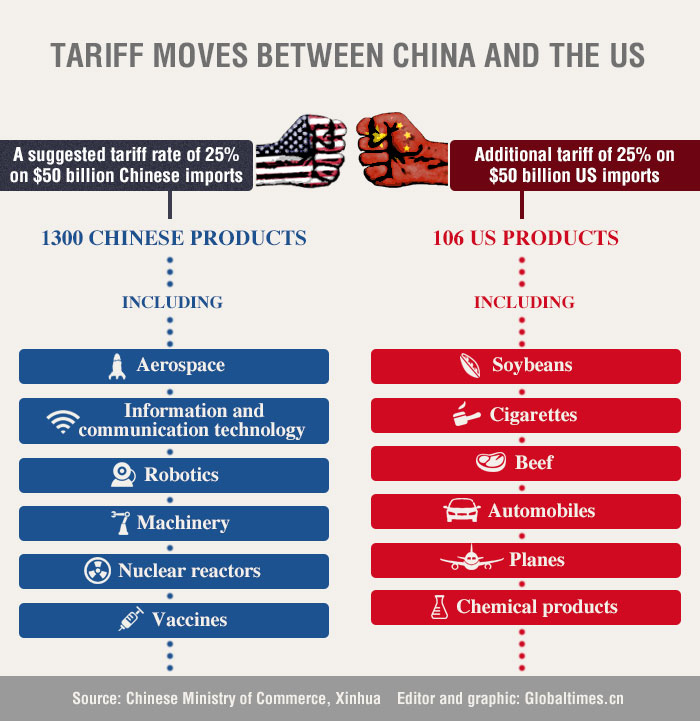

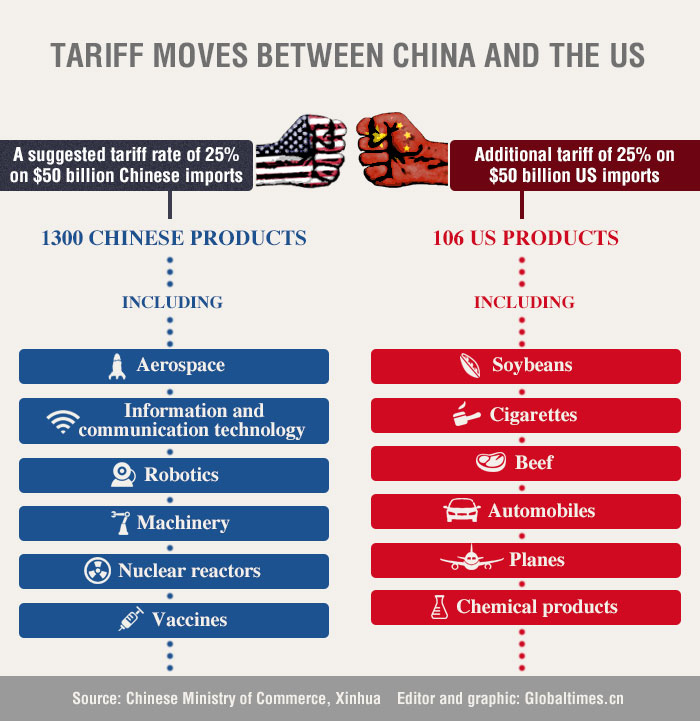

- Tariff moves between China and the US - Global Times

- US-China Tariff War: What are the Implications for the Healthcare Industry?

- Tariff moves between China and the US - Global Times

- Trump tariffs explained: Will they raise costs for Americans? | wqad.com

- Section 301 Tariff Updates: USTR Grants Exclusions & Seeks Comments on ...

- United States and China Trade War: Tariff Showdown - UWL | Freight ...

- Understanding the US Tariff Increase on Chinese EVs - DVGA

- USA and China tariff rate changes since January 2018 | Download ...

The Chinese government's decision to impose tariffs on $60 billion worth of US goods is a direct response to the Trump administration's decision to impose tariffs on $200 billion worth of Chinese goods. The US tariffs, which went into effect on September 24, were the latest in a series of protectionist measures implemented by the Trump administration, which has accused China of unfair trade practices and intellectual property theft.

The Chinese tariffs, which range from 5% to 84%, will apply to a wide range of US goods, including agricultural products, chemicals, and machinery. The move is expected to have a significant impact on US exporters, who will face higher costs and reduced demand for their products in the Chinese market. The tariffs will also have a ripple effect on the global economy, as trade flows and supply chains are disrupted.

Impact on the US Economy

The imposition of tariffs by China is likely to have a significant impact on the US economy, particularly in industries that rely heavily on exports to China. The US agricultural sector, for example, is expected to be hit hard, as China is a major market for US soybeans, corn, and other agricultural products. The tariffs will also affect US manufacturers, who will face higher costs and reduced demand for their products in the Chinese market.

The trade war is also having a broader impact on the US economy, as businesses and consumers become increasingly uncertain about the future of trade relations with China. The US stock market has been volatile in recent months, as investors worry about the impact of the trade war on corporate earnings and economic growth.

Global Implications

The trade war between the US and China has significant implications for the global economy, as trade flows and supply chains are disrupted. The International Monetary Fund (IMF) has warned that the trade war could reduce global economic growth by up to 0.5% in 2020, as trade tensions and uncertainty weigh on business confidence and investment.

The trade war is also having a broader impact on the global trading system, as other countries begin to take sides and impose their own tariffs and trade restrictions. The European Union, for example, has imposed tariffs on US goods in response to the Trump administration's decision to impose tariffs on European steel and aluminum exports.

In conclusion, the trade war between the US and China is escalating, with China's decision to impose tariffs of up to 84% on US goods in retaliation against the Trump administration's latest round of tariffs. The move is likely to have a significant impact on the US economy, particularly in industries that rely heavily on exports to China. The trade war also has significant implications for the global economy, as trade flows and supply chains are disrupted and uncertainty weighs on business confidence and investment.

Note: This article is for general information purposes only and is not intended to be taken as professional advice. The views and opinions expressed in this article are those of the author and do not necessarily reflect the views and opinions of CNN or any other organization.