Table of Contents

- Fannie Mae Upgrades Data Validation Capabilities in Desktop Underwriter ...

- Fannie Mae vs Freddie Mac vs Ginnie Mae | Finance Strategists

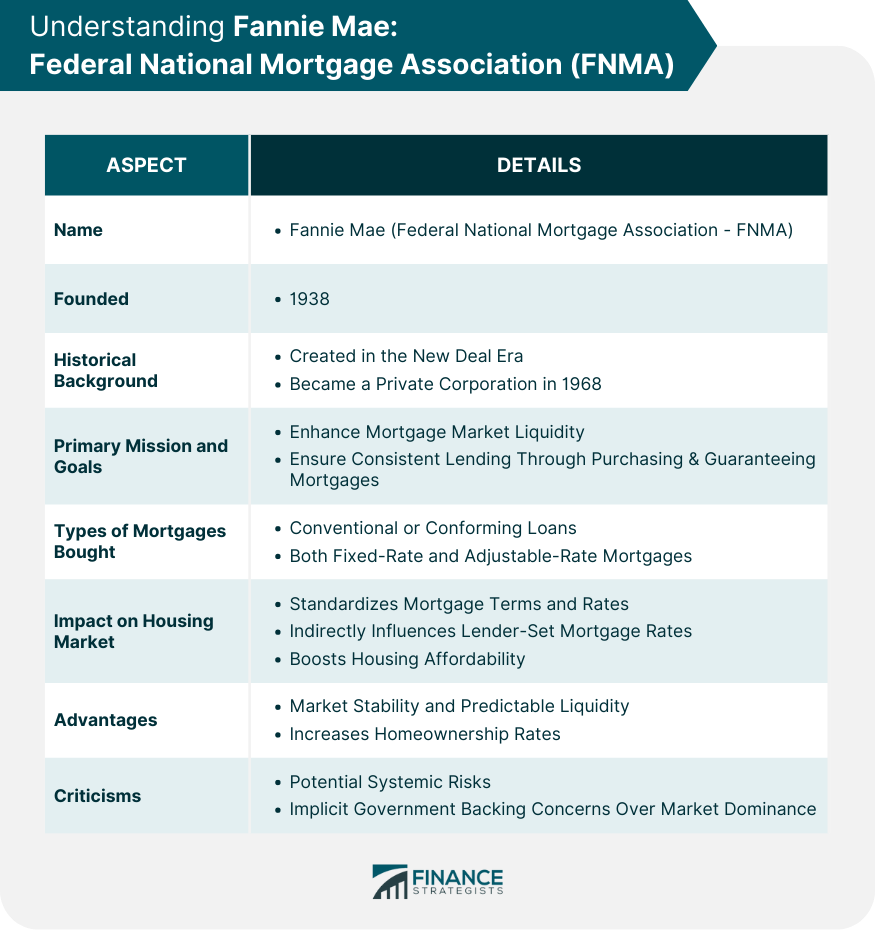

- Fannie Mae

- Economy Will Tip Into ‘Modest Recession’ in Q1 2023, New Fannie Mae ...

- What is Fannie Mae & Freddie Mac and How Do They Work? - Jackie Mack

- What is Fannie Mae & Freddie Mac and How Do They Work? - Jackie Mack

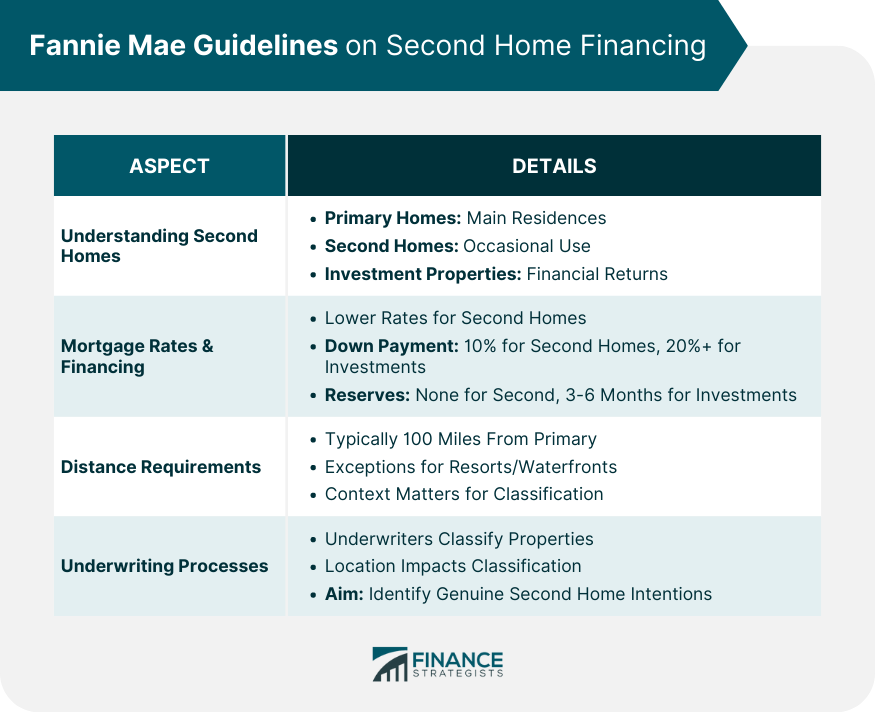

- Fannie Mae Second Home Guidelines | Bennett Capital Partners

- Fannie Mae Prepares for Possible Losses on Multifamily Loans This Year

- Fannie Mae Guidelines on Second Home Financing

- Fannie Mae Logo And Symbol, Meaning, History, PNG | atelier-yuwa.ciao.jp

/cloudfront-us-east-1.images.arcpublishing.com/dmn/7H33H57C3NHJLBZM7GA4GZO2KU.jpg)

The terminated employees, who were not named, were found to have engaged in various forms of unethical conduct, including falsifying documents, misrepresenting information, and violating company policies. The investigation, which was launched after a whistleblower came forward, revealed a culture of dishonesty and lack of accountability within certain departments of the company. Fannie Mae's leadership has assured stakeholders that the company is taking immediate action to address the issue and prevent similar incidents in the future.

Consequences of Unethical Conduct

In addition to the financial implications, the scandal also raises questions about the company's internal controls and oversight mechanisms. How could such widespread misconduct go undetected for so long? What measures were in place to prevent or detect such behavior? These are questions that Fannie Mae's leadership and regulatory bodies will need to answer in the coming weeks and months.

Rebuilding Trust and Integrity

The company will also need to work closely with regulatory bodies and stakeholders to demonstrate its commitment to integrity and compliance. This may involve regular audits and monitoring, as well as cooperation with investigations and enforcement actions. By taking these steps, Fannie Mae can begin to rebuild trust and restore its reputation as a leader in the mortgage finance industry.

The termination of over 100 employees at Fannie Mae is a shocking reminder of the importance of ethics and compliance in the mortgage finance industry. The scandal highlights the need for robust internal controls, effective oversight, and a culture of integrity and accountability. As the company works to rebuild trust and restore its reputation, it is essential that stakeholders, including investors, regulators, and customers, hold Fannie Mae accountable for its actions.By prioritizing ethics and compliance, Fannie Mae can emerge from this scandal stronger and more resilient than ever. The company's leadership has a unique opportunity to set a new standard for integrity and transparency in the industry, and it is essential that they seize this opportunity to restore trust and confidence in the mortgage finance sector.

Keywords: Fannie Mae, unethical conduct, employee termination, mortgage finance industry, scandal, internal investigation, integrity, compliance, transparency, accountability, regulatory bodies, stakeholders, ethics, training, education, policies, procedures, audits, monitoring, enforcement actions, reputation, trust, leadership. Meta Description: Fannie Mae has terminated over 100 employees due to unethical conduct, sparking a scandal that raises concerns about the mortgage finance industry's integrity. Read more about the consequences and the company's efforts to rebuild trust. Header Tags: - H1: Fannie Mae Embroiled in Scandal: Mass Employee Termination Over Unethical Behavior - H2: Consequences of Unethical Conduct - H2: Rebuilding Trust and Integrity - H2: Conclusion Image: A relevant image of a person or a graph representing the termination or the Fannie Mae logo can be used here. Internal Linking: Link to other relevant articles about Fannie Mae, the mortgage finance industry, or corporate scandals. External Linking: Link to reputable sources such as news articles or official statements from Fannie Mae regarding the scandal.