Table of Contents

- TSMC Share Price Drops To Record Low As Rival Takes Chipmaking Lead ...

- TSMC Share Price Drops To Record Low As Rival Takes Chipmaking Lead ...

- TSMC Company on Stock Market. Taiwan Semiconductor Company Financial ...

- TSMC Share Price Drops To Record Low As Rival Takes Chipmaking Lead ...

- TSMC is soon to announce the construction of a factory in Dresden ...

- TSMC Stock Deserves a Trillion-Dollar Valuation - Wealth Daily

- Menemukan 50 Perusahaan dengan Kapitalisasi Terbesar di APAC

- TSMC: Secular Trends And Market Potential Make It A Strong Buy Ahead Of ...

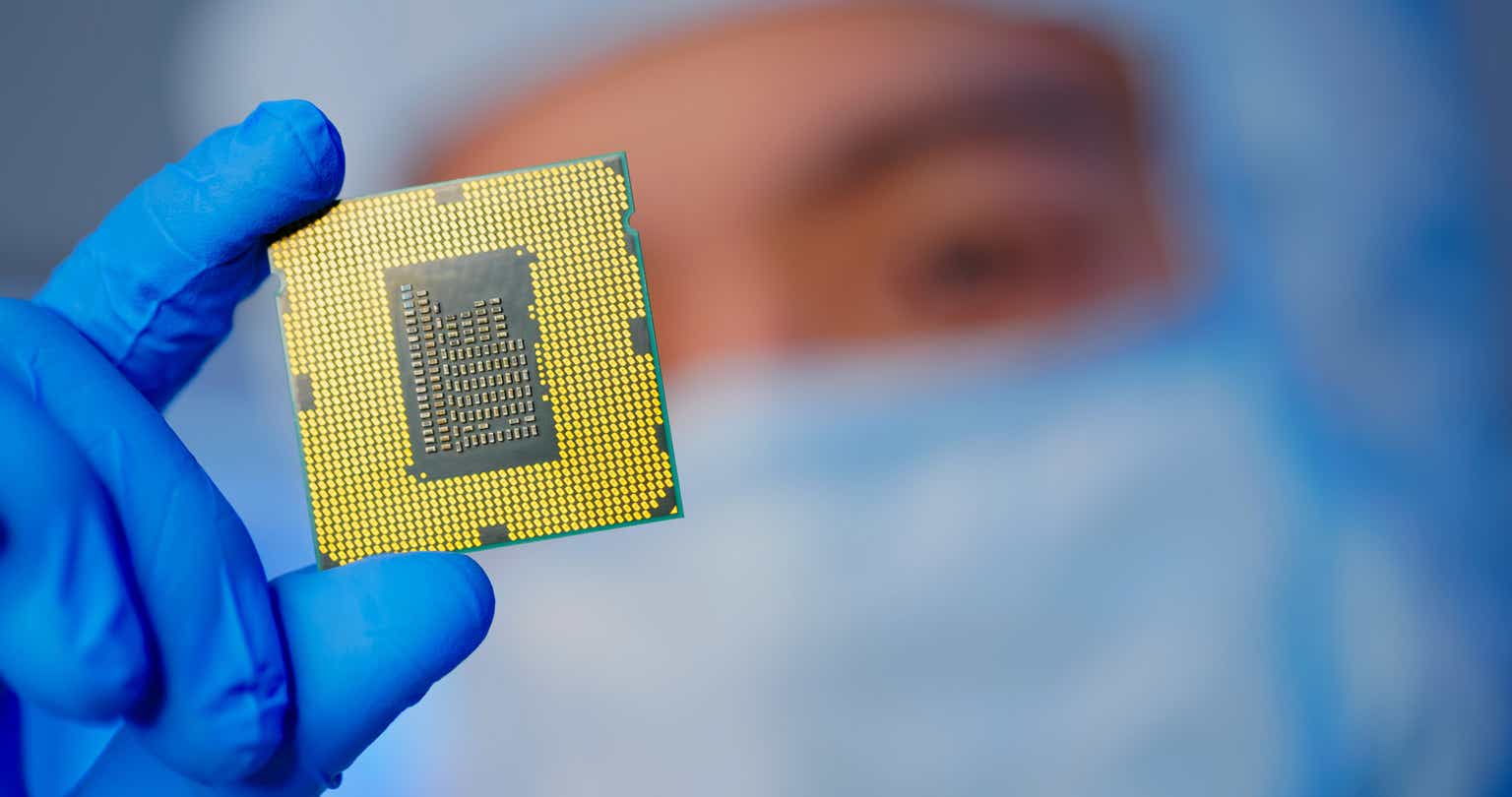

- Nancy Pelosi's Taiwan Visit Highlights World's Biggest Chip ...

- TSMC omits customer data in answers to US chip shortage inquiry ...

Current Stock Price and Quote

Recent News and Developments

Stock Performance and Trends

The Taiwan Semiconductor Manufacturing stock price has been on an upward trend in recent years, driven by the growing demand for semiconductors in various industries, including smartphones, automotive, and IoT. The stock has outperformed the broader market, with a year-to-date return of over 50%. Analysts expect the stock to continue its upward trend, driven by the company's strong fundamentals and growth prospects. However, the TSM stock price is not immune to market volatility and has been affected by trade tensions between the United States and China. The company's reliance on international trade and its exposure to the Chinese market make it vulnerable to geopolitical risks. Investors should closely monitor the news and developments in the trade tensions to assess their potential impact on the TSM stock price. In conclusion, the Taiwan Semiconductor Manufacturing stock price is a closely watched indicator of the company's performance and the overall health of the semiconductor industry. With its strong fundamentals, growth prospects, and expanding production capacity, TSMC is well-positioned to capture a larger share of the growing semiconductor market. However, investors should be aware of the potential risks and challenges, including trade tensions and market volatility. As the demand for semiconductors continues to grow, the TSM stock price is expected to remain a key focus for investors and industry analysts alike.For the latest news and updates on the Taiwan Semiconductor Manufacturing stock price, please visit our website or follow us on social media. Our team of experts provides timely and insightful analysis of the stock market, helping investors make informed decisions.

Disclaimer: The information provided in this article is for general information purposes only and should not be considered as investment advice. Investors should conduct their own research and consult with financial advisors before making any investment decisions.